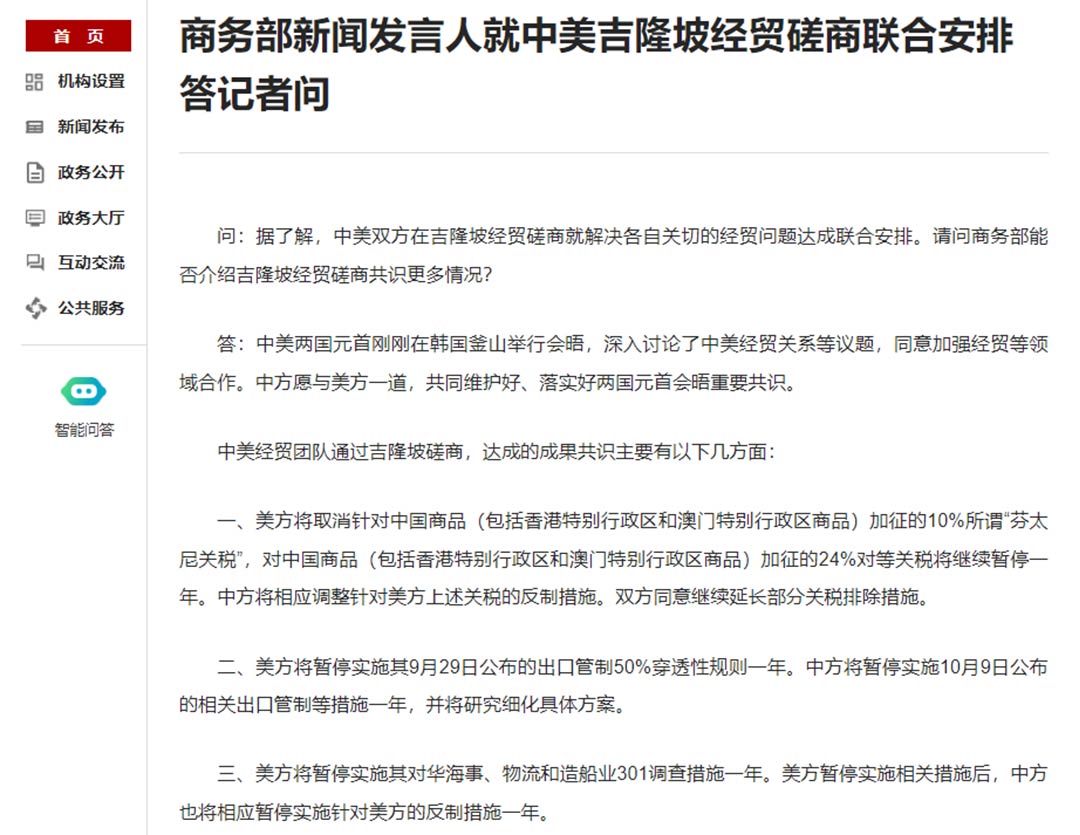

Recent U.S.-China trade relations have shown a series of positive developments. Based on the consensus reached during the Kuala Lumpur consultations, the U.S. has officially removed the 10% "fentanyl tariff" imposed on Chinese goods and suspended the 24% additional tariff for one year. China has correspondingly adjusted its countermeasures and extended some tariff exclusion policies. These actions signify a further consolidation of the "rolling truce" mechanism initiated in May 2025, creating a phase of stable conditions for Sino-U.S. trade.

(Image source: Ministry of Commerce of the People's Republic of China)

Cost Pressure Eases, Profit Margins Improve

For cross-border export enterprises, the suspension of the 24% additional tariff is the most direct benefit. The comprehensive cost for related goods is expected to decrease by approximately 20%, significantly improving profit margins. Sellers can adopt various strategies: maintain current prices to directly boost profits, moderately reduce prices to expand market share, or reinvest part of the profits into advertising and user experience optimization to gradually build brand influence.

Market Expectations Stabilize, Business Confidence Warms

Beyond the improvement in costs, the stabilization of the policy environment is equally crucial for boosting market confidence. From the U.S.-China leaders' meeting in Busan to the multiple consensuses reached in Kuala Lumpur regarding tariffs, export controls, and Section 301 investigations, both sides have demonstrated a willingness to manage differences through dialogue. For cross-border businesses, this enhances short-term operational predictability.

Sellers can now more calmly plan their Q4 and year-end inventory rhythms. Advertising investments, logistics arrangements, and promotional activities no longer require frequent adjustments due to sudden policy shifts. As consumer acceptance of Chinese-made products recovers, export demand is expected to improve further, shifting the industry overall from "defensive operations" towards "proactive planning."

Challenges Persist Amid Opportunities, Proactive Response is Key

Although the current situation has eased, risks are not entirely eliminated. The 24% tariff is merely "suspended," not "canceled." Whether it continues after one year depends on subsequent negotiations. If sellers over-expand or hoard inventory during this window, they may face cost rebound pressures in the future.

Furthermore, as overall costs decrease, more Chinese products are expected to return to the U.S. market, potentially intensifying platform competition and increasing the risk of price wars for homogeneous goods. The profit recovery driven by policy dividends is temporary; long-term competitiveness still hinges on product differentiation and brand value.

The current phase is both a period for profit recovery and capability upgrading. As an Amazon SPN service provider, 1981 Company will continue to empower sellers, helping transform external policy advantages into internal operational resilience. This ensures enterprises can navigate steadily through uncertain trade environments and achieve the leap from "opportunistic growth" to "systematic development."

With the majestic snow-capped peaks as inspiration, initiate the grand blueprint for innovation - Walk hand in hand, set sail for new horizons, and reach out to the world!

A bowl of Laba porridge carries millennia of Chinese tradition It simmers with harvest, fills with company warmth, and touches hearts deeply This winter is warmer together, the new year stronger united

Copyright © 2015-2026 Shenzhen 1981 Technology Co., Ltd. All Rights Reserved.